- Why Digital Nomad?

Become a Digital Nomad

Become a digital Nomad in one of the four countries that we offer

Choose a Location

Become a Digital Nomad and start a company at the same time

- How it works

Products for Digital Nomads

Digital Nomad Kit

Become a digital Nomad in one of the four countries that we offer

Digital Nomad Kit Pro

Become a Digital Nomad and start a company at the same time

Products for starting a company

Start a Company Kit

We take care of all the hassle from creating a company in our locations

Shelf-Company

Take advantage and register a company without traveling to Bulgaria.

Crypto Exchange Company

Enter the cryptocurrency exchange market with our services

- Locations

- Blog

- Marketplace

Wherever you are located and whatever needs your business has, starting a company in the locations we suggest provides significant competitive advantages like flexibility, better climate, and living conditions as well as the tax benefits prevailing in each of the countries.

Start a company

in Cyprus

- Corporate tax: 12.5 %

- Personal tax: 0% – 35%

- Capital gains tax: 20%

- VAT tax: 19%

- Social Insurance: 8.3% – 15.6%

Not sure where to start?

Schedule your Tax-Strategy

Call with our Experts.

Get a personalized action plan for your

individual situation.

- Corporate tax: 12.5 %

- Personal tax: 0% – 35%

- Capital gains tax: 20%

- VAT tax: 19%

- Social Insurance: 8.3% – 15.6%

General Characteristics

and Advantages of Companies in Cyprus

Low taxation of profits

and dividends

Wherever you are located and whatever needs your business has, starting a company in the locations we suggest provides significant competitive advantages like flexibility, better climate, and living conditions as well as the tax benefits prevailing in each of the countries.

Very little

bureaucracy

Setting up a company in Cyprus is hassle-free due to minimal bureaucratic hurdles. The streamlined processes and efficient government procedures enable entrepreneurs to focus on their core operations.

Remote company setup

and bank account opening

Cyprus allows for remote company setup and bank account opening, eliminating the need for physical presence. This convenient option saves time and resources, enabling businesses to commence operations quickly.

Access to European

support programs

Companies in Cyprus may be eligible to utilize European support programs and funding opportunities. As an EU member state, Cyprus grants access to EU grants, incentives, and collaborative initiatives, enhancing growth prospects.

Low maintenance

costs

Cyprus offers a cost-effective business environment with low maintenance costs. This includes affordable office spaces, competitive labor expenses, and reasonably priced utilities, optimizing cost structures for businesses.

Why GuideForeigners

Working with us offers the following advantages:

Business-focused

approach

We work and think as business people and not as lawyers. We prioritize practical solutions over a purely legal mindset, ensuring our services align with your business goals.

Extensive European market knowledge

With a presence in five countries, we possess in-depth understanding of the European market, supporting your business expansion.

Competitive pricing with exceptional professionals

Our prices are highly competitive, combined with the expertise of our dedicated professionals who are always available to assist you.

We work and think as business people and not as lawyers. We prioritize practical solutions over a purely legal mindset, ensuring our services align with your business goals.

- Corporate tax: 12.5 %

- Personal tax: 0% – 35%

- Capital gains tax: 20%

- VAT tax: 19%

- Social Insurance: 8.3% – 15.6%

Categories of

potential customers

1.

Service-providing

companies

2.

Companies involved in

triangular sales

3.

Companies with remote

working staff

4.

Freelancers

5.

Companies eligible for

European program funding

3 types of company

structure

Once you have made the decision to start a business in Cyprus, it is important to determine the appropriate structure for your company. In Cyprus, there are three types of company structures available for registration, which are dependent on the nature of the business and the financial regulations in the country.

Option 1

Sole

Proprietorship

We work and think as business people and not as lawyers. We prioritize practical solutions over a purely legal mindset, ensuring our services align with your business goals.

View more

Option 2

Extensive European market knowledge

With a presence in five countries, we possess in-depth understanding of the European market, supporting your business expansion.

View more

Option 3

Competitive pricing with exceptional professionals

Our prices are highly competitive, combined with the expertise of our dedicated professionals who are always available to assist you.

View more

Cost you need to know about

- Costs of setting up a company for LLC, 1900euro one-off cost +VAT

- Company maintenance costs, 90 euro/month

- Company address cost – Virtual office, 50 euro/month after the first year

- End-year maintenance 1000 euro annual

Payroll

- The lowest salary in Cyprus is 850 € gross

- Social security contributions in Cyprus amount to 40%

Do I have any risk if I create a company in Cyprus

and invoice my clients from there?

If you decide to create a company in Cyprus and invoice your clients from there, there are certain considerations and potential risks you should be aware of.

Firstly, establishing a company in Cyprus requires complying with the country’s legal framework. This entails fulfilling the necessary requirements for company formation, such as registering your company with the relevant authorities and adhering to corporate governance regulations.

Cyprus offers an appealing tax regime for businesses, including a favorable corporate tax rate and various tax incentives. However, tax laws can be intricate, and it is essential to have a clear understanding of the specific tax obligations and implications associated with operating your company in Cyprus.

It’s important to note that creating a company in Cyprus is a legitimate and internationally recognized business entity. To ensure a smooth process and avoid any potential issues, it is crucial to follow the prescribed procedures and meet the specified deadlines outlined by the Cypriot government.

The creation of the company by Guide Foreigners

includes the following services

1.

Registration of the Company

2.

Legal Expenses

3.

Approval of name

4.

Preparation of forms for the registrar

5.

Registration Certificates

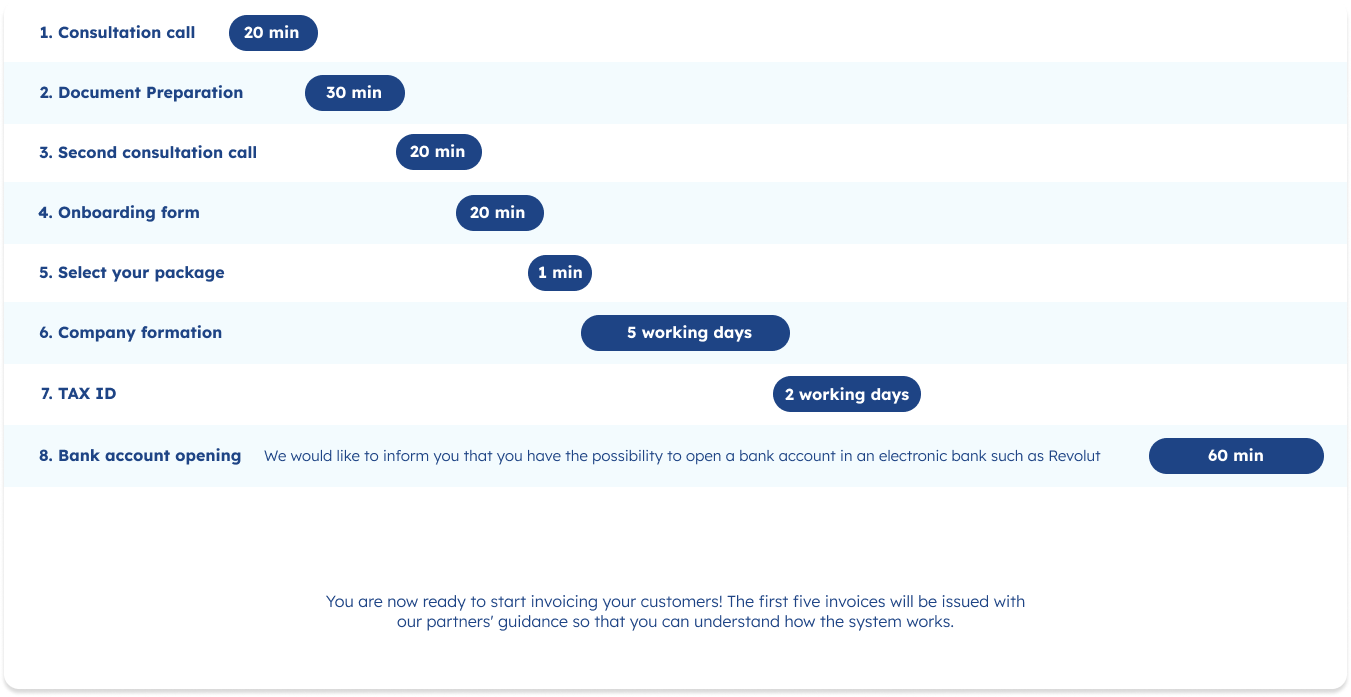

Timeline

The process timeline

1.

Consultation call

After the first contact by we had e-mail we will have a 20 min call where we will answer any questions you have about the establishment and management of the company in Cyprus

2.

Document Preparation

You need to gather all the necessary documents needed to prepare for the next step which is the establishment of the company

3.

Second consultation call

In this meeting, we will answer questions that may have been raised since our last call and we will review together the documents you have collected

4.

Onboarding form

You will need to fill in the form sent to you and upload the necessary documents

5.

Select your package

Complete online the purchase of the package you have chosen after the guidance of our partner in the second call

6.

Company formation

The process of establishing your company has started, our partners are preparing all the applications that will have to be submitted to the competent authorities of the Republic of Cyprus in order to create your company according to your requirements

7.

TAX ID

Once the company is ready another application needs to be filed for the company to go into VAT proper status. This allows you to invoice customers abroad

8.

Bank account opening

In Cyprus, we have the possibility to open a bank account online. This process will be done as soon as the company activation process is completed